by Soren K.

Overview

Technical systems are calling for continued weakness in Gold and strength in the USD. Technical analysis being what it is, that is correct until it no longer is. What matters is the risk/reward scenarios presented by such analysis. As Statistical traders and Option geeks we do not claim to be technicians. But the tool is useful in conjunction with other factors after one has developed an opinion and is looking for an entry or exit point to implement that opinion.

-Soren K.

Brexit, Volatility, and Value

From our point of view, Gold has been relatively strong. It is among the last markets to go back into pre-Brexit mode. That is a pleasant sight given that hot money makes Gold more volatile on a daily basis than other mediums of exchange. Which also means it could have further room lower. As we said over the last week, our own VBS trade signal has given entries and non profitable 3 day exits to the downside in Gold and Silver. But if you ignored the volatility, as we do not on VBS signals, both markets have softened since. If you ignore the volatility as an investor you will be more comfortable. and yesterday’s DB report gave us impetus to comment on that. If Gold can be $300 higher from where it is now based on one correlation, then why isn’t it? Because of volatility. Price is not value. Price is a snapshot in time. Value is relative price over a period of time. We hope to elaborate on that more later today after the close.

-interactive chart HERE

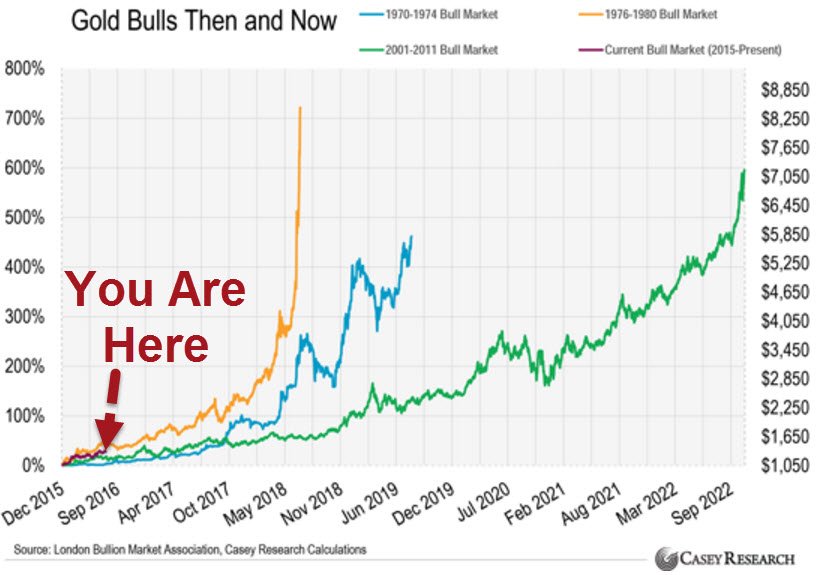

Is This Gold’s 5 Year Plan?

DEC GOLD Resist: 1333-133670, 134590* ST Trend: Down

(132670) Supprt: 1316-1313, 1300+/- Obj: 1316- TRP: 1345.90

Comment: The market continues to signal a downturn from the congestion of recent weeks and targets a

selloff to 1316 with a chance to wash to 1300-. Corrective congestion must stay under Friday’s high and

tight congestion below 1335 should bear flag, using 1-2 days of choppy sideways action to prepare for

selloffs. A close over 134590* alerts for a reversing turnaround.

DEC SILVER Resist: 19105, 19385-1940* ST Trend: Down

(18945) Supprt: 18495, 18375, 1811- Obj: 1811 TRP: 1940.0

Comment: The market is in a downturn and a close under 18375 could add a wash along 1811-. Any

additional rebounds or corrective congestion will likely stall inside Friday’s range and use sideways

congestion to bear flag and setup for selloffs. A pop over 1914 is near term friendly. However, only a close

over 1940* triggers a reversing turnaround

SEP US DOLLAR Resist: 9557*, 9600-9606, 9670+ ST Trend: Sdwys

(95543) Supprt: 95225, 9594-90, 9472* Obj: None TRP: 95.57

Comment: Friday’s outside bull reversal day leaves a failed downturn and should continue upside action to

attack over 9557* resistance. A close over 9557* confirms a drive to 9670+. Friday’s strong close favors

continuation rallies. Any corrections should be contained to tight congestion in the upper half of Friday’s

rally to bull flag. A close under 9472* is needed to rekindle bear trend forces.

Previous Technical Reports

- Gold Technicals: Weak longs spoofed out yesterday

- Technicals: USD, Gold, Silver Weak. VBS trade update

- Technical Recap: the Silver Short Autopsy

- Technical Brief: Silver defiant, Fischer Fails

Good Luck

Soren K.

Disclaimer© 2010 Junior Gold ReportJunior Gold Report’ Newsletter: Junior Gold Report’s Newsletter is published as a copyright publication of Junior Gold Report (JGR). No Guarantee as to Content: Although JGR attempts to research thoroughly and present information based on sources we believe to be reliable, there are no guarantees as to the accuracy or completeness of the information contained herein. Any statements expressed are subject to change without notice. JGR, its associates, authors, and affiliates are not responsible for errors or omissions. Consideration for Services: JGR, it’s editor, affiliates, associates, partners, family members, or contractors may have an interest or position in featured, written-up companies, as well as sponsored companies which compensate JGR. JGR has been paid by the company written up. Thus, multiple conflicts of interests exist. Therefore, information provided herewithin should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. No Offer to Sell Securities: JGR is not a registered investment advisor. JGR is intended for informational, educational and research purposes only. It is not to be considered as investment advice. Subscribers are encouraged to conduct their own research and due diligence, and consult with their own independent financial and tax advisors with respect to any investment opportunity. No statement or expression of any opinions contained in this report constitutes an offer to buy or sell the shares of the companies mentioned herein. Links: JGR may contain links to related websites for stock quotes, charts, etc. JGR is not responsible for the content of or the privacy practices of these sites. Release of Liability: By reading JGR, you agree to hold Junior Gold Report its associates, sponsors, affiliates, and partners harmless and to completely release them from any and all liabilities due to any and all losses, damages, or injuries (financial or otherwise) that may be incurred.

Forward Looking Statements

Except for statements of historical fact, certain information contained herein constitutes forward-looking statements. Forward looking statements are usually identified by our use of certain terminology, including “will”, “believes”, “may”, “expects”, “should”, “seeks”, “anticipates”, “has potential to”, or “intends’ or by discussions of strategy, forward looking numbers or intentions. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results or achievements to be materially different from any future results or achievements expressed or implied by such forward-looking statements. Forward-looking statements are statements that are not historical facts, and include but are not limited to, estimates and their underlying assumptions; statements regarding plans, objectives and expectations with respect to the effectiveness of the Company’s business model; future operations, products and services; the impact of regulatory initiatives on the Company’s operations; the size of and opportunities related to the market for the Company’s products; general industry and macroeconomic growth rates; expectations related to possible joint and/or strategic ventures and statements regarding future performance. Junior Gold Report does not take responsibility for accuracy of forward looking statements and advises the reader to perform own due diligence on forward looking numbers or statements.